What If The Hartford Denies My Disability Insurance Claim?

If The Hartford Insurance company denied your insurance claim, you have an ally to help you fight back. Call Donahue & Horrow. We’re a Los Angeles-based law firm that has successfully secured millions of dollars for our clients in denied disability claims.

Have no doubt. We know how to put pressure on insurance giants like The Hartford to require them to pay you the money you are rightfully owed. We can help you whether you purchased your policy directly from The Hartford (in which case you could be entitled to bad faith insurance damages) or you were provided insurance by your employer (in which case, you claim is likely governed by the complicated Federal law known as ERISA).

Our goal is simple: to make sure you are treated with dignity and respect while securing the insurance benefits that you legally deserve.

Call us today if you think that you’ve been treated unfairly or unethically by The Hartford: (877) 664-5407.

Whether you have an individual disability claim, group short-term disability claim, group long-term disability claim, health insurance claim, life insurance claim, AD&D claim or long-term care insurance claim. We are available to help you with your case and to discuss any questions you may have about your insurance policy or The Hartford denied insurance claim.

Donahue & Horrow is based in Los Angeles, but routinely handles cases throughout California. Call us at 877-664-5407. We can even meet with you face-to-face at your location to discuss your insurance claim, if necessary.

The Hartford Tactics In Denial of Disability Insurance Claims

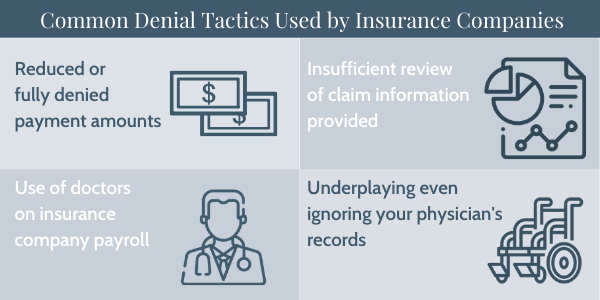

The Hartford’s tactics to deny or delay disability and other insurance benefits follow a familiar insurance industry playbook:

- Payouts that are less than what the policyholders were entitled to receive.

- Insufficient review of disability claims appeals.

- Using biased physicians to support bogus claim denials.

- Ignoring the opinions of your primary care physician and other medical specialists who support your claim.

The Hartford and other insurance companies often try to “wear down” policyholders like you in the hope that you will give up rather than fight for your benefits. If The Hartford has tried one or more of these tactics on you, they may be trying to fraudulently deny your insurance claim:

- Repeatedly making burdensome requests for more and more documentation, which often duplicates documentation you already submitted;

- Downplaying medical evidence – including objective and subjective data – which supports the disability or entitlement to insurance benefits;

- Denying your claim because it is only supported by “subjective” evidence, even if the policy does not require “objective” evidence;

- Resorting to requesting so-called “independent” medical reviews by unqualified physicians or individuals;

- Lengthy delays in making a decision on a disability insurance claim.

There Are Deadlines. Do Not Delay!

If you’re dealing with a denied insurance claim from The Hartford, we urge you to take action. Do not delay! All insurance claims have strict deadlines that must be met if you are to have any hope of collecting the insurance benefits you are owed. This is especially true if your claim is governed by ERISA. Call us today at (877) 664-5407. Our legal team will treat you with the dignity you deserve while fighting relentlessly to secure the insurance benefits you are owed.

If you have questions call us. Insurance policies are written by lawyers, so sometimes it takes a law firm to interpret the terms of the policy. We will assist you in deciphering your insurance policy issued to you by The Hartford, whether it be a long-term disability insurance policy, short-term disability insurance policy, health insurance policy, life insurance policy, accidental death, and dismemberment policy or a long-term care insurance policy. Call today for a free consultation: (877) 664-5407.